Crypto platforms feel like gambling because they are: Users are drawn to high-risk behaviour

When Kim Kardashian paid a fine in 2022 for promoting a cryptocurrency token without disclosing she was paid, and Matt Damon declared “fortune favours the brave” in a crypto ad, it was clear that cryptocurrency had fully entered mainstream pop culture.

But behind the celebrity endorsements and flashy Super Bowl commercials lies something more familiar — and far more concerning.

Crypto trading platforms, where millions buy and sell digital currencies, don’t just resemble casinos; in many ways, they operate like them. Beneath the surface of charts, tokens, and tech buzzwords are systems designed to encourage risky behavior, all while quietly profiting when users lose.

These platforms aren’t just marketplaces for digital assets. Many of them deliberately blur the line between investing and gambling, using flashy design and game-like features to turn speculation into entertainment. At the same time, they obscure the mechanics of how their systems work — especially how they earn money from user losses.

Recent research by a team of Concordia University–affiliated scholars (including us) sheds light on how these platforms truly function. What appears to be innovation often masks a business model built on risk, distraction, and user disadvantage.

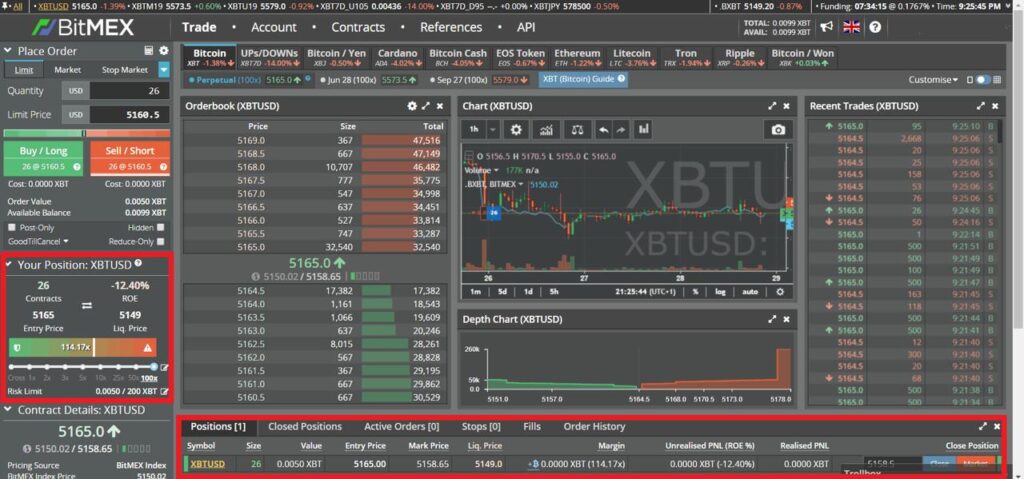

A Case Study in Platform Design: BitMEX

Consider BitMEX, a prominent crypto exchange that became infamous for offering traders up to 100x leverage — allowing users to control massive positions with a fraction of the actual capital. It’s the digital equivalent of making huge bets using borrowed chips.

The risks of such trading are obvious. Yet BitMEX’s interface downplayed these dangers, presenting the experience more like a high-speed game than a serious financial decision. Real-time stats, sleek UI, flashing indicators, and dopamine-triggering feedback loops encouraged users to keep coming back.

This is where BitMEX’s design stands out: it transformed high-stakes financial risk into entertainment. And although its market share has since declined, the influence it left behind is everywhere. Today, many crypto exchanges use similarly gamified interfaces, leverage options, and social dynamics.

These aren’t just flashy features. They’re core to how platforms generate revenue from user behavior, much like casinos — which rely on high volume and frequent play, not player success.

The House Always Wins

Crypto platforms aren’t merely marketplaces; they’re systems engineered to benefit from constant engagement and volatility. Whether users gain or lose, platforms earn a cut from every trade, every swap, every liquidated position.

And like casinos, the house — in this case, the exchange — is always at an advantage.

The result is a trading environment where user risk is maximized, not minimized, and profits flow upward. The success of the platform doesn’t depend on the success of its users — it depends on their continued activity.

When Speculation Becomes Survival

This shift reflects a larger trend: financialization — where more aspects of everyday life are shaped by the logic and structures of financial markets. From student loans and retirement savings to health insurance and side hustles, people are increasingly forced to think of their lives as investment portfolios.

In this world, crypto feels like a natural progression. It offers the illusion of control and financial empowerment — especially appealing to those locked out of traditional systems or disillusioned by them.

To many, crypto represents autonomy, opportunity, and even transformation. It casts users as entrepreneurs of the self: bold, independent, navigating risk in search of reward.

But Inequality Runs Deep

There’s a darker side to this vision. Financialization deepens existing inequalities. Those with capital can invest early, reap compound returns, and spread their risk. Those without are urged to “get in early,” hold through losses, and take on more risk than they can afford.

Crypto platforms operate within — and reinforce — this structure. They aren’t neutral. They are designed to offload risk onto users while collecting profits from every transaction. The more users trade, the more the platform earns — regardless of whether the users win or lose.

Gamblification: Turning Risk into Play

Gamblification describes the process by which activities not traditionally associated with gambling adopt the aesthetics, mechanics, and psychological appeal of games of chance. This concept offers a critical framework for understanding how cryptocurrency platforms engage users—even as those users experience significant financial losses.

Our research shows that crypto exchanges rely heavily on features like real-time leaderboards, dynamic visual effects, and meme-driven communities to frame trading as a form of entertainment. Even substantial losses are often shared with humor or irony, transforming failure into something communal and playful.

This reframing creates a culture where risk-taking becomes a badge of honor. The figure of the “degen”—short for “degenerate”—epitomizes this mindset: a trader who knowingly engages in reckless, self-destructive investment behavior, but is celebrated for doing so.

Within this ecosystem, addiction-prone patterns are reinforced. Financial losses aren’t treated as systemic failures, but as moments of participation in a larger social game. Platforms benefit from this dynamic. By making high-stakes speculation feel lighthearted and game-like, they increase user retention, activity, and ultimately, profit. This is not accidental—it is engineered.

The Double Bind of Crypto Platforms

The fusion of financialization and gamblification creates a structure eerily similar to casino capitalism. Users are lured into risky behavior not just by misleading promises, but by systems that offer the illusion of freedom and participation while profiting from their engagement—especially their failures.

This creates a paradoxical user experience. On one hand, individuals feel empowered: they’re making autonomous decisions, chasing rewards, and taking part in a cultural movement. On the other hand, they are operating within systems that are most profitable when users lose. The language of “innovation,” “disruption,” and “financial freedom” masks a more extractive reality.

Our findings suggest that this is not a metaphorical resemblance to gambling—it is a structural one. Cryptocurrency platforms operate like casinos: they rely on opaque rules, asymmetrical information, and behaviorally engineered feedback loops that keep users engaged, regardless of individual success.

Why This Matters

The convergence of finance and gamblification has implications that extend far beyond crypto. As traditional financial services adopt similar tactics—push notifications, social leaderboards, celebratory animations—the line between investing, speculation, and gambling grows increasingly blurred.

This cultural shift naturalizes high-risk behavior, while shifting the burden of failure onto individuals. It erodes support for regulation, reframes volatility as inevitable, and obscures the systemic nature of financial harm.

Understanding this dynamic is essential for policymakers, educators, designers, and the public. Cryptocurrency is not just a new asset class; it is a proving ground for new models of digital exchange—as well as exploitation and control.

Though crypto often claims to represent decentralization and innovation, it more frequently reflects larger systems of speculative risk and dispossession. Users are drawn into a game they cannot win—one where platforms always profit, and losses are dressed up as play.