Financial market crises have far-reaching impacts on people across the globe. The detailed trading data these events generate offers insight into the complex human behaviors that contribute to such disruptions. We propose that large-scale data generated through online activity—particularly search behavior—can provide a fresh perspective on how market participants react during periods of significant market volatility. By analyzing fluctuations in Google search volumes for finance-related terms, we identify patterns that may serve as early warning indicators of upcoming stock market movements. These findings highlight the potential of integrating vast behavioral datasets to deepen our understanding of collective human decision-making in financial contexts.

Introduction

The rise of large-scale “big data” reflecting everyday human behavior offers a powerful new opportunity to address fundamental questions about our increasingly complex world. Financial markets, due to their global impact on individual wealth and geopolitical stability, have emerged as a prime focus for such quantitative research. As a result, there is growing scientific interest in understanding market behavior through modeling, simulations, and network analyses.

At the heart of financial markets lie countless individual decisions made by traders. As Nobel laureate Herbert Simon noted, decision-making typically begins with information gathering. In the digital age, this often takes the form of online searches. Google, through its publicly accessible service Google Trends, now offers aggregated data on the volume of search queries over time. In this study, we explore how such data can offer insight into the decision-making processes that precede trading behavior.

Prior research has shown that online activity correlates with investment behavior. For instance, click patterns from a specific country align with investment levels in that country. Temporal analysis of Google Trends data has also linked search activity with real-world phenomena, such as flu outbreaks and stock market transaction volumes. Similar findings using Yahoo! data support this relationship. Other studies have connected Google Trends to key economic indicators like car sales, unemployment claims, and consumer confidence. Interestingly, it has also been found that users in wealthier countries are more inclined to search for information about the future than the past.

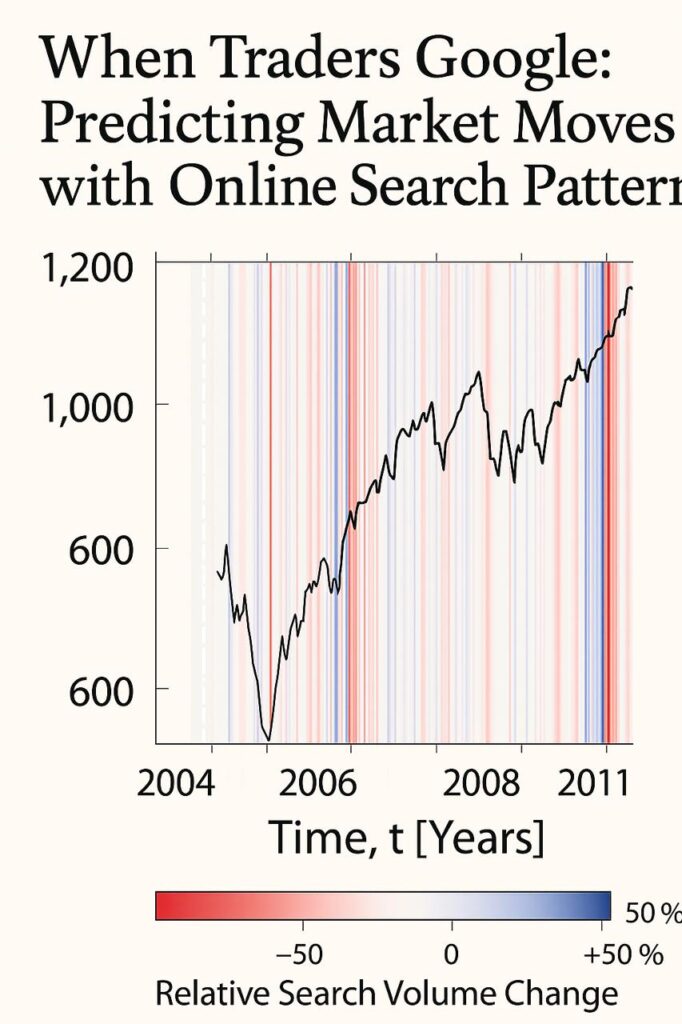

Building on this work, we propose that during the 2004–2011 period, Google search data not only reflected current market conditions but may have also anticipated future market movements. Specifically, we suggest that declines in market performance were preceded by increased search activity—possibly indicating heightened investor concern. If so, search query volumes could serve as early indicators and even form the basis for profitable trading strategies.

Results

We examined the performance of 98 search terms, most of which were finance-related and some of which were recommended by Google Sets—a tool for identifying semantically related keywords. The search terms were intentionally chosen to introduce a financial bias. To illustrate our approach, we highlight results for the term “debt”, which had strong semantic relevance to the 2008 financial crisis and proved to be the most predictive keyword in our dataset.

To analyze how search behavior might correlate with trading activity, we compared the weekly closing prices of the Dow Jones Industrial Average (DJIA), denoted as p(t), with Google search volumes for each term. For a given week t, we used Google Trends to extract the number of searches n(t − 1) for a specific keyword during the previous week. This data is normalized by Google against total search volume and may vary slightly across data collection dates. To control for this, we averaged three separate data samples for each keyword, collected over three consecutive weeks. These differences had minimal effect on the results and aligned with known market events (see Supplementary Fig. S1).

To measure changes in search behavior, we calculated the relative change in search volume:

To measure changes in search behavior, we calculated the **relative change** in search volume:

Δn(t,Δt)=n(t)−N(t−1,Δt)

where:

N(t−1,Δt)=Δtn(t−1)+n(t−2)+⋯+n(t−Δt)

Here, t is measured in weeks, and Δt denotes the size of the historical time window used to establish a baseline. Figure 1 presents the relationship between these relative changes in search volume for the term “debt” and the weekly closing prices of the DJIA.